Mortgage Portfolio Optimization

Improving Lead Conversion and Customer Retention

Lead & Portfolio Optimization

Customers today demand a more individualized approach to their personal finances. Financing a home is about more than rate and payment. Demographics, and psychographics aren’t destiny. Mortgage lenders and servicers need to individualize their pitch to (prospective) borrowers, and their mindsets, rather than just age, gender and their status of “in the market” or “in the money” to optimize:

- “Speed to Lead” and “Lead to Lock” in New Acquisition Campaigns

- Borrower retention through reduction of churn

- Customer Engagement throughout the life-cycle of their loans.

Features

Scaled automation of individualized campaigns, enhanced email analytics, and patented Think-alike clustering power the next conversation with the right message through every phase of the mortgage life-cycle.

Direct integration to Velocify ensures borrower profiles are always updated near real time, and content is hyper-contextualized to the borrower’s current state of mind.

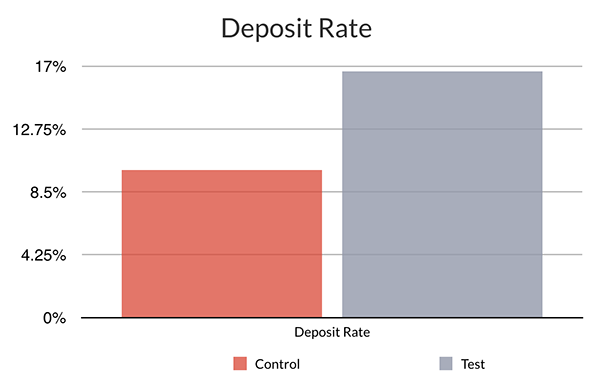

Personalized Content Drives 22.3% Reduction in Churn, $1,485,000 in Value

Based on available 1st party data and faster moving signals, Discourse Analytics worked with a top-50 bank’s marketers to develop borrower profiles.

Then, Discourse Analytics matched the right message to the right borrower to reduce mortgage churn (defined as mortgages refinanced at another financial institution). Compared with the control group, Discourse Analytics achieved a 22% reduction in churn rate at the 99% confidence level resulting in $1,485,000 in incremental value.

Differentiators

- Patented, Artificial Intelligence-driven platform.

- No Personally Identifiable Information (PII) stored

- Machine learning drives continuous message optimization

- Loan Portfolio: 125,000

- Avg. Loan Size: $150,000

- Loan Servicing Rate: 0.3%

- Benefit per loan: $450

- Control / Test Churn Rate: 11.84% / 9.2%

- Loans Saved: 3,300

$1,485,000

Incremental Value